It’s never been easier or safer to pay your bills while you’re waiting for your morning coffee or to check your bank balance as you taxi home from dinner on Friday. In fact, the majority of Canadians now use online and mobile banking as their main way of banking. But for many, losing a mobile phone the size of your palm means losing a lot of important information.

Everything from vital contact information to photos of special moments and sensitive personal financial information is made vulnerable when your phone is lost or stolen.

But by taking some preemptive and protective strategies, the damage can be minimized or averted.

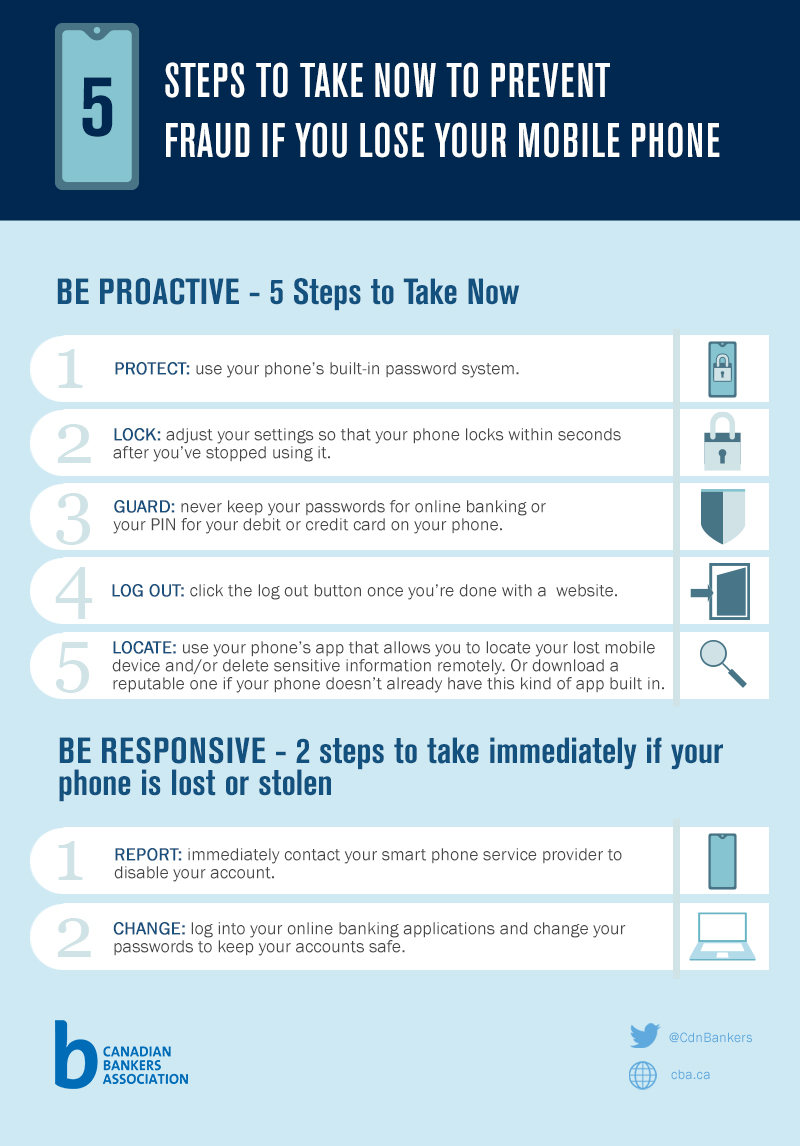

Be proactive – five steps to take now

- Use your phone’s built-in password system. If you have a smart phone with a Personal Identification Number (PIN) style password, make sure to create a tricky PIN; 1234 is too easy for a thief to guess.

- Adjust your settings so that you phone locks within seconds after you’ve stopped using it.

- Never keep your passwords for online banking or your PIN for your debit or credit card on your phone. If your phone is taken along with your wallet and you have these passwords stored, it will make it easy for the thief to take money out of your account.

- Log out of websites once you are done using them. Again, don’t make it easy for someone looking to defraud you to access your bank account or personal information.

- Use your phone’s app that allows you to locate your lost mobile device and/or delete sensitive information remotely. Or download a reputable one if your phone doesn’t already have this kind of app built in.

If your phone is lost or stolen

Immediately contact your smart phone service provider to disable your account. Your phone’s unique identifier (known as the IMEI or International Mobile Equipment Identity number) will be added to a “blacklist” and participating Canadian wireless service providers will not allow it to be used on their respective wireless networks.

Change your online banking passwords in order to keep your accounts safe.