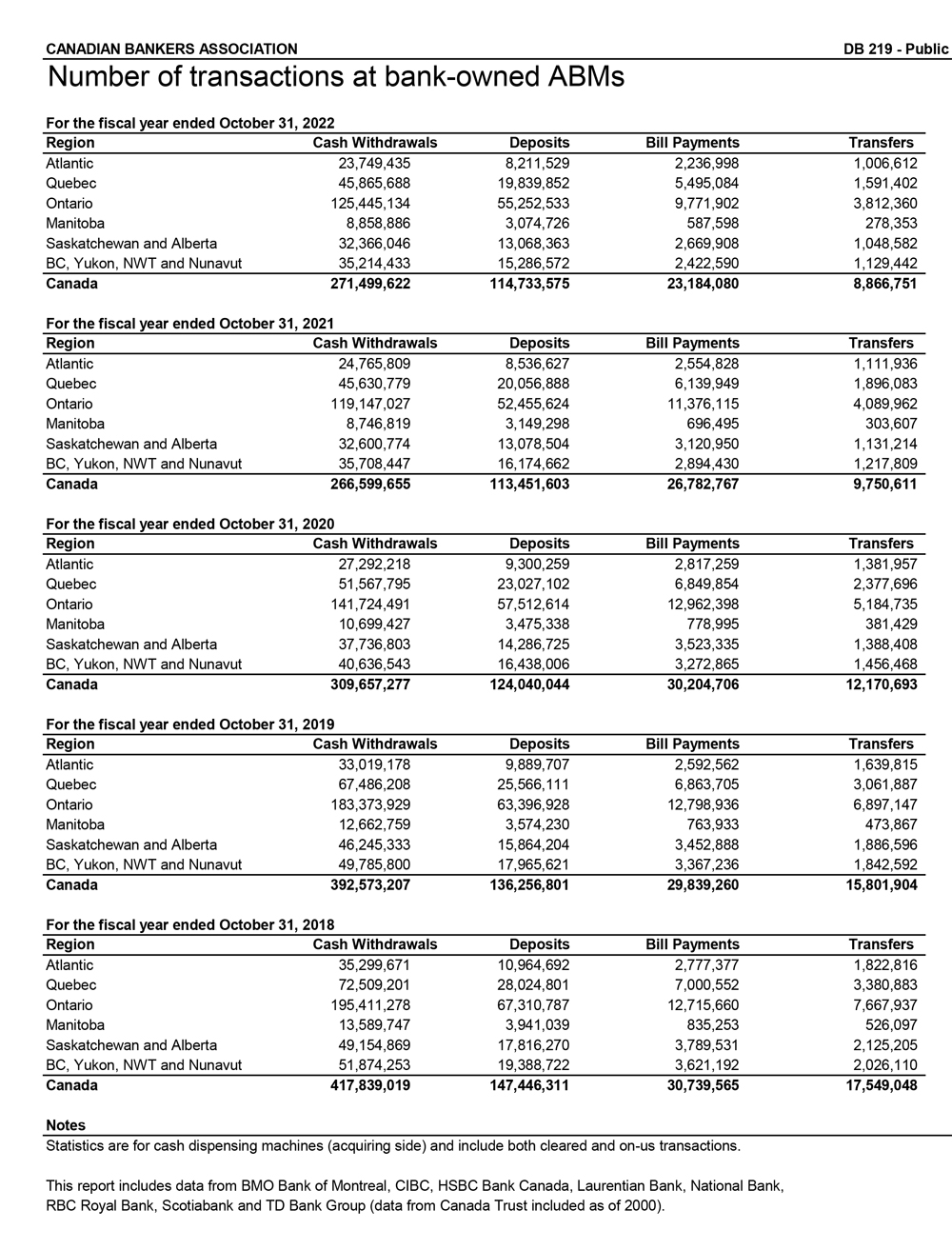

Automated Banking Machines (ABMs) remain an important banking service in Canada and many Canadians still rely on ABMs to withdraw cash, make deposits, pay bills and transfer funds. As the availability of digital services continues to shape the way Canadians manage their finances, a growing number of banking customers are transitioning towards online banking platforms to conduct banking transactions such as bill payments and transfers. This shift is contributing to a decline in the use of ABMs to conduct some banking transactions over time.

Chart: Number of transactions at bank-owned ABMs as of October 2022.